What is the best mortgage to get?

With so many mortgage products available the choice can be overwhelming and what is right for one individual isn’t necessarily the best option for another.

So here’s our quick guide to mortgages and which one might be best for you:

Fixed Rate Mortgage

A fixed rate mortgage is a mortgage where your interest rate is guaranteed to stay the same for a set period of time.

This can offer peace of mind because, unlike a variable rate mortgage (such as a tracker), you’ll know exactly how much you’ll need to repay each month during this period.

Fixed rate deals can last between one and 10 years. You can currently fix your rate for one, two, three, five, seven or 10 years. One-year fixed-rate mortgages are much less common and tend to only be available for borrowers with specific requirements, such as those buying with a Help to Buy equity loan or wanting to borrow a large amount.

Generally speaking, the longer your fixed-rate deal lasts, the higher the interest rate will be. This is because it is harder for a lender to predict what will happen in the market over a longer period of time – you’re essentially paying for the security of knowing that your rate won’t go up no matter what happens.

Tracker Mortgage

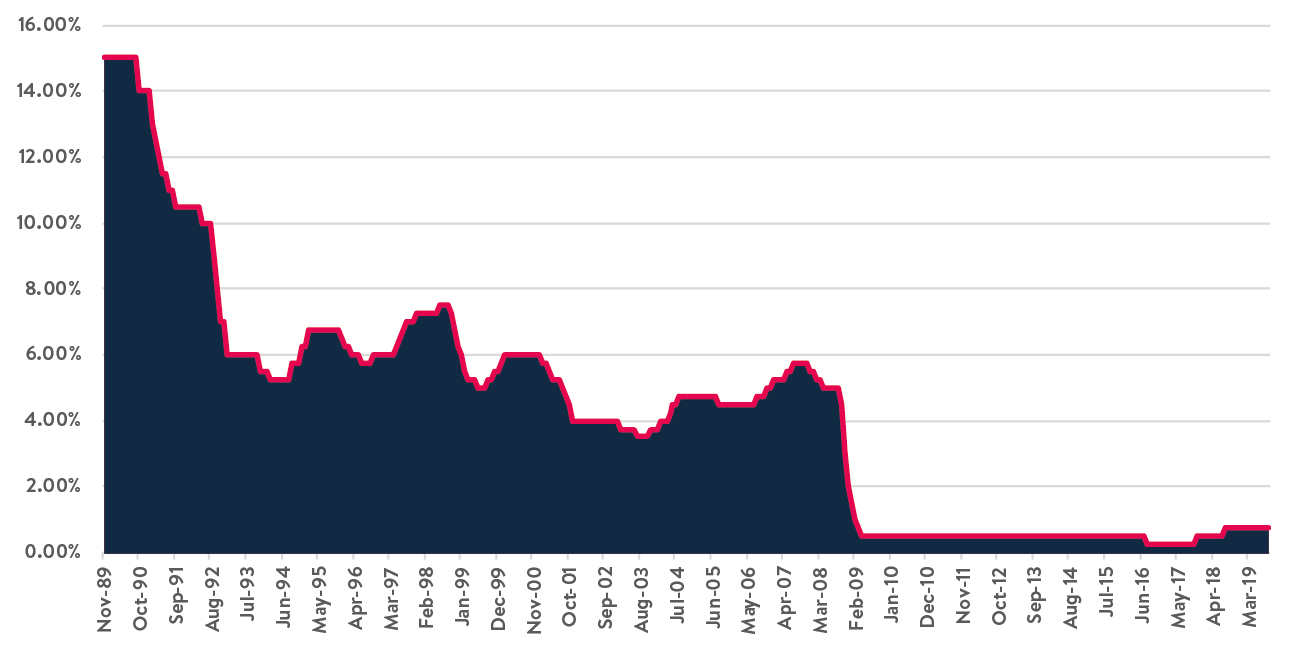

A home loan where the interest rate you pay is based on an external rate – usually the Bank of England base rate – plus a set percentage. The base rate is currently 0.75%. So, if the interest rate on a tracker mortgage was the base rate +1%, the amount of interest you would pay is 1.75%. If the base rate went up, the interest rate on your tracker mortgage would also rise.

Because a tracker mortgage is a type of variable rate mortgage, the total amount that you pay each month could change.

With each monthly mortgage payment, part of the money goes towards the interest charged by your lender and the other part towards repaying the money you’ve borrowed (the capital).

If your monthly payments increased because of a rise in the Bank of England base rate, the extra money you paid would only cover the increased interest charges – so you’d be paying more each month without actually clearing a greater proportion of your mortgage debt.

Repayment Mortgage

With a repayment mortgage, you pay back a small part of the loan and the interest each month.

Assuming you make all your payments, you’re guaranteed to pay off the whole loan at the end of the term.

Interest-Only

With an interest-only mortgage, you only pay the interest on the loan. At the end of the term, you’ll still owe the original amount you borrowed.

With an interest-only mortgage, your monthly payment pays only the interest charges on your loan, not any of the original capital borrowed.

This means your payments will be less than on a repayment mortgage, but at the end of the term, you’ll still owe the original amount you borrowed from the lender.

At Curchods Mortgage Services we are here to help you make the right decision. As an independent firm who covers the whole of market we have access to exclusive deals with some of the biggest lenders such as Halifax, Natwest and HSBC. Call us today to find out how we can find the right mortgage for you.