As life expectancies continue to increase in the UK, we’re living longer and longer into our retirement which is obviously a good thing – but as with every other stage in life, it’s important to think about our financial situation so that we can live life to the full as we grow older.

It’s a common situation for homeowners approaching retirement to find themselves relatively cash poor on a day to day basis, whilst at the same time own a very valuable home, especially in the south-east of England.

Since property is often our most valuable asset, if you want more financial freedom in your retirement, it’s worth investigating the options available to help redress the balance between equity tied up in property vs disposable income.

Simon Labrow, Senior Mortgage Advisor and Equity Release specialist at Curchods Mortgage Services explains the modern-day options for those looking to use their home to help fund retirement.

Downsizing

For some, the large family home was a necessity when the children were growing up, but now they’ve flown the nest it could be that we are left still having to heat, maintain and pay taxes on a property (and garden) which is likely too large for our needs, or it could be that health issues are making the stairs an impossibility – downsizing can be a practical and economical way of lightening the heavy that could be holding you back.

Sadly, many people delay the move to a smaller property for too long and as a result, some end up being pressured to sell through ill health or financial worries. Our advice if you are thinking of downsizing, start investigating your options as far in advance as you can. Doing this will keep you in control of how, if and when you move home and help youto get the greatest financial benefit from the move.

Equity Release

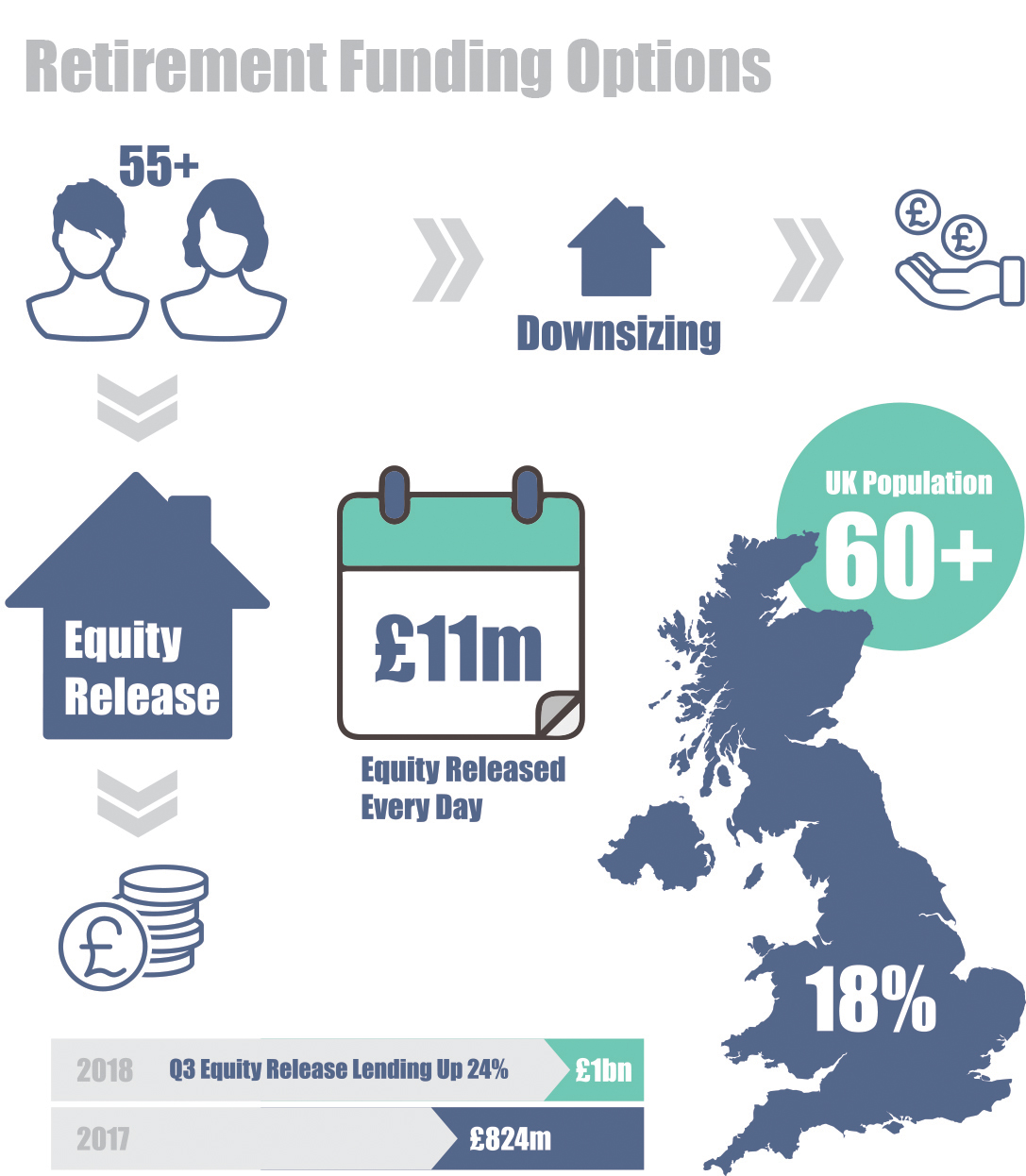

Downsizing isn’t for everyone, so you’ll be pleased to hear there are alternatives. If you are over 55 and own your own home you could be eligible for a lifetime mortgage.

A lifetime mortgage is a form of equity release, essentially a long-term loan secured on your property, but instead of you making repayments, interest is added to the loan every year at a fixed rate. Both the loan and the interest are repaid in full, usually from the sale of your property when you die or go into long-term care.

Lifetime mortgages give you the benefit of unlocking some of the money tied up in your home without you having to move.

The Equity Release Council’s Autumn 2018 Market Report shows the range of lifetime mortgage product options available on the market has more than doubled in the last two years.

This year has seen the number of people applying for equity release rise to unprecedented levels, with 12,016 new equity release plans agreed between July to September 2018. This equates to homeowners aged 55 and over releasing the equivalent of £11m from their homes every day.

Why Consider A Lifetime Mortgage?

A tax free lump sum or regular income with no monthly repayments could help with the extras you’d like to afford during retirement, such as:

- Repaying your existing mortgage or other debts to reduce your monthly outgoings

- Topping up funds to buy a home closer to family in a more expensive area

- Home improvements to make it more suitable for you as you grow older

- Distributing some of the equity in your home to children so that you can see them benefit from their inheritance in your lifetime

- Help children onto the property ladder (the bank of mum and dad is still one of the biggest sources of deposits for First Time Buyers.)

- That once in a lifetime holiday that you’ve always dreamt of.

If any of the above sound familiar, a lifetime mortgage might be worth considering.

What makes these specialist products different to traditional mortgages is that income is not always needed to secure the mortgage and many have no maximum age for the mortgage to finish.

The loan and interest could be repaid through the eventual sale of your home or alternatively, you can pay the interest, subject to the terms and conditions of the provider.

What Lenders Are Saying

Lenders are keen to help and have confirmed that 2018 has seen the highest levels of lending for lifetime mortgages ever!

Modern mortgage options are regulated and very different to the inflexible and expensive old-style options available in the past. You retain ownership of your home with equity release mortgages.

Industry data reveals that third-quarter lending activity in 2018 saw over £1bn of property wealth unlocked for the first time in any quarterly period. The total was up £195m (24%) since Q3 2017, from £824m as the market and product range continues to grow to satisfy wider consumer demand.

This milestone comes just weeks after the Government backed a recommendation by the Housing, Communities and Local Government Select Committee. It recommended that equity release should feature among the home finance options that will be signposted to older people by the new Single Financial Guidance Body, to help support a more rounded approach to later-life financial planning.

Personal advice to choose the option that best suits your needs…

Choosing to release money from your home is a big decision and there’s more than one option when it comes to boosting your retirement funds, so it’s important to look at all the choices available to you alongside all the benefits and considerations. A lifetime mortgage would, for example, impact the inheritance you may want to leave or could affect your entitlement to means-tested benefits.

If you would like to have an initial chat, please give Simon Labrow a call on 01483 479070 to arrange a time that suits you, or fill in the form below and we can arrange for Simon to contact you directly.