Our journey on the housing ladder tends to follow a cycle. As a first time buyer, our first home is likely to be small as it is financially challenging for many to get on the property ladder.

As we start a family and our income grows though promotions at work, necessity or desire for more space leads many of us to move to a larger property.

But as the years go by, children grow up and leave home and retirement appears closer on the horizon. At this point the plan for many people is to move back to a smaller property, possibly on the coast or in a more rural part of the country, where property prices are lower and they can enjoy a more relaxed lifestyle. A move which is often referred to as Downsizing.

The Government’s English Housing Survey 2017-2018 reported that Downsizing was a major reason behind why the older generation decided to move, with 37% of 55-64 year olds and 28% of over 65 year olds stating that they wanted a smaller house or flat.

The generation of people born before the mid 1950s own £1.7tn worth of residential property. The same generation account for the majority of outright property owners in the UK, with 64% of outright owners being 65 or over, underlining the vast potential wealth benefits of downsizing.

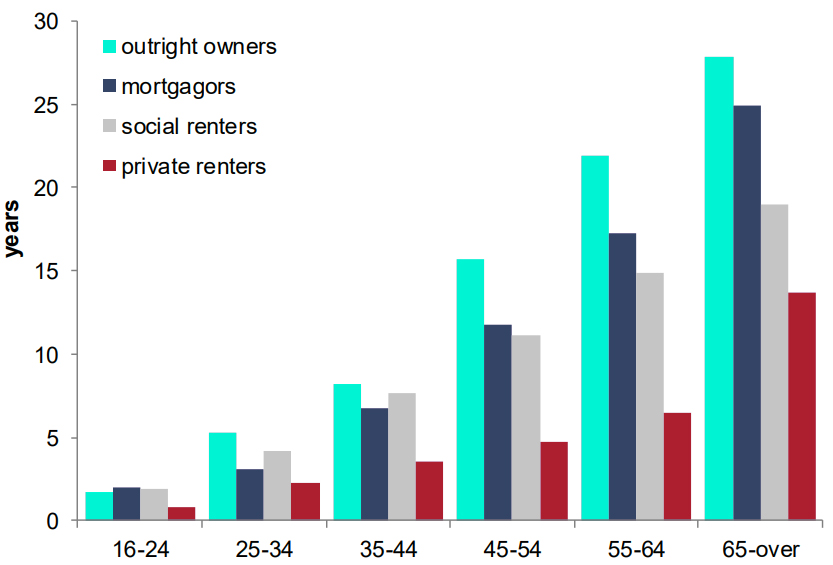

The over 55’s are also the ones that have lived in the same property for the longest period of time, which is why leaving the long standing family home can make the move to Downsize so challenging.

Average Years In Current Accommodation By Age

Source: English Housing Survey 2017-2018

What are the advantages of Downsizing?

Improved Financial Situation

The average house price in Surrey has increased by approximately 55% in the last 10 years, so if you have been living in your property and paying off your mortgage for a long time, it is likely that your home will have increased in value enough that selling it will pay off your mortgage to fund a move to a smaller property, as well as free up some additional money to let you live life as you want to.

Less To Maintain

As we get older, our physical ability to decorate, maintain and clean a large home is going to diminish, so many decide to move to a small property so they can spend less time on these chores and spend more time living life to the full.

Physically More Suitable

As we age our bodies might be more suited to single story living – downsizing can allow us to move to a flat or a bungalow.

Sadly too many people leave downsizing too late until they are forced into it by physical constraints. It is much better to move to a smaller property whilst you are still able to lift boxes and arrange furniture than leave it too late when you ‘need’ to live on one floor.

Starting to plan your move early will give you much more choice and many more options as to where you are going to live.

Lower Carbon Footprint

Smaller homes are generally more eco-friendly and use less energy, which means your energy bills will be lower.

As well as lower heating, water and energy bills, your Council Tax should also come down, putting you in a better situation financially.

The Start Of A New Chapter

When the time comes for many people to sell their family home there are many emotions involved. It can feel like one of the toughest moves for people as there are a lot of memories attached to the home they have lived in for years, but likewise, now the property is empty and the children have flown the nest, you don’t want the emptiness to be your lasting memory of living there.

Thankfully with the right advice and enough planning, downsizing doesn’t have to feel like the end of a chapter, but rather the start of a new one where you can enjoy living somewhere smaller that is easier to live with.

Take That Dream Holiday

Downsizing can also be the catalyst to take that dream holiday you’ve been planning all your working life. Once you’ve paid off your mortgage by downsizing, you may have more disposable income to spend on things like holidays. Equity Release is another option to consider in this regard.

How to Downsize successfully

Downsizing isn’t just for retirement. It can be an desirable option at any stage of your life.

If you’ve not moved in a long time it can be confusing as to where to start. To help, here we offer some advice on what to consider if you are thinking of moving to a smaller property:

Early Preparation Is Key

Planning early is the best way to successfully downsize. Give some thought to what is important in your life. As an exercise think of some answers to the following questions, which may help you decide on what sort of property you want to move to:

- What do you enjoy doing in your current home?

- Where are the grandchildren going to sleep?

- How much space do you actually need?

- What will you do with your furniture in a smaller property?

- What will the family think – how far away are they going to be?

- Is it safe financially – what are you going to do with the money from the sale of your existing property?

- What is involved with moving home?

- Do you actually need to downsize or are there other options that better suit your personal circumstances?

It is important to decide if you really want to move. Establish the key reasons and motivators behind why you are thinking of downsizing.

Consider if the house or the garden is why you want to downsize. If you no-longer want or need a garden, perhaps a flat or apartment might be appropriate? Decisions like these will help you decide on what sort of property you want to buy and help you be better prepared when you start your search.

Plan For The Future

It’s important when you start thinking about downsizing to a smaller property that you don’t only think about what you want from a property tomorrow, but also what you are going to want in 10 or 20 years time? Is the property still going to be suitable then, as it’s unlikely you will want to go through the process of moving again as you get older.

New Build properties are a great option to consider as they will require very little maintenance, be equipped with brand new appliances and many come with a 10 year warranty for the building.

Where do you want to move to?

Many people have a dream that when they retire, they move to somewhere more rural or by the coast. As part of planning for the future, you need to think about where you want to move to.

It is worth considering how far away you want to move away from your children and grandchildren and how will this affect how much you see them and is that what you want. Food for thought.

If you are thinking about further afield, some people decide to let their current property to allow them to try the new area before committing to a move. This allows you to move to the West Country for example, rent a property down there and make sure it is where you really want to live. ‘Rent before you buy’ allows you to try several towns over a period of time without the hassle of selling your own home and the added security you can return back to your family home if it doesn’t work out. If this sounds like something you would like to pursue, please book a consultation with one of our lettings teams who can give you an indication of the rental yield you can expect for your property.

Search Retirement Properties

Rightmove has a specific filter to help you look for Retirement properties, many properties for sale will specify that they will only let people of retirement age purchase the property, creating a sense of community and support structure where you live, close to people with similar interests.

Consider Hidden Costs

As part of the planning process, it’s a good idea to find out about all the costs associated with moving, such as:

- How much will it take to get your property market ready, does it need redecorating or other essential repairs?

- What will the estate agent and Conveyancing fees be?

- Will you need smaller furniture in a smaller home?

- Find out about Council Tax and utility bill costs expected in your smaller property.

Declutter

Downsizing is a great opportunity to finally get round to the job you’ve been putting off for the last 20 years… decluttering.

There are several benefits to having a clear out – it’s likely the smaller property won’t have space to house everything you’ve built up over your lifetime and secondly, decluttering is one of the simplest ways to increase the saleability and/or rentability of your property!

Presenting a property to potential buyers and tenants in as clean and uncluttered condition as possible, can have significant benefits to the speed of transaction (and sometimes price or rental income).

Here are our top tips for decluttering your home:

- Adopt the ‘6 month rule’: If you’ve not used or worn it in the last six months, consider whether you need to keep it. Make exceptions for seasonal items.

- Declutter one room at a time: Be determined, ruthless and organised – decide what you definitely want to keep, but temporarily remove it from the house for selling purposes.

- Remember this is about getting ready to move: “Is it coming with you?” is the question to ask yourself.

- Avoid asking others for their opinion on what to keep or remove: Instead have the courage of your convictions (at least for the things that are yours)!

- There are several worthy recipients of any items you decide to remove: charity shops are always looking for good stock. You could sell items online or offer them to family or friends. For larger items you wish to keep, but need to temporarily remove, use a storage firm.

When your declutter is complete you will not only feel happier and more relaxed, but your property will undoubtedly attract more attention from potential buyers and/or tenants.

Embrace The Smaller Space

Less space doesn’t mean less life – downsizing is a chance to have a complete change in your lifestyle.

We speak to many people, who after moving to a smaller property, use this as a chance to get out the house more so they aren’t constrained within a smaller home. They often say they go and see friends more, go for more dog walks and meet up with family.

The smaller configuration of your new home may have more open plan space giving you more quality time together.

Don’t Leave It Too Late

The worst possible outcome would be that you are forced into downsizing and it isn’t what you want, for example if your health deteriorates to a point where you have to move to a smaller or more suitable property, or your financial situation dictates you have to unlock some equity from your home.

It is because of the fear of moving that many people delay doing so until they are forced into it by financial circumstances or ill health. Starting to think about downsizing early, while you are still in good health, will put you in control and give you more time to find the perfect property to fit in with your lifestyle.

If you are looking for more reasons, take a couple of minutes to watch TV’s finest property guru Phil Spencer, explain downsizing in the following video:

Scroll down for alternatives to downsizing…